Modern Finance

In the ever-evolving realm of finance, businesses are increasingly turning to Enterprise Resource Planning (ERP) systems to streamline and enhance their financial management processes. Modern finance, marked by dynamic market conditions, global connectivity, and data-driven decision-making, demands a sophisticated approach to managing financial operations. ERP systems serve as the backbone of this evolution, providing organizations with a comprehensive and integrated platform to optimize financial processes, improve efficiency, and drive strategic decision-making.

With Sprint365, your business gains a number of advantages and benefits

Meet some of our customers

Why should you choose Sprint365?

Take our test and discover if your business is ready to elevate itself to new heights with Microsoft Dynamics 365 for Finance & Operations!

Download our ‘Guide to Dynamics 365’ now and get answers to the 13 most crucial questions that will assist you and your company on the journey with Sprint365.

Sprint365 Modern Finance contains a wealth of functionality that will strengthen your business from day 1

FINANCIAL ANALYSIS & REPORTING

In the world of finance, the ability to analyze and report on financial data is paramount. Financial Analysis & Reporting is the cornerstone of informed decision-making, providing businesses with crucial insights into their financial performance. This essential function empowers organizations to assess profitability, identify trends, and communicate financial health to stakeholders.

FORECASTING

In finance, foreseeing future trends is crucial. Financial Forecasting utilizes historical data to predict outcomes, aiding proactive planning and informed decision-making.

PROCESS AUTOMATION

Efficiency is key in finance. Financial Process Automation uses technology to streamline workflows, minimizing errors, and freeing resources for strategic pursuits.

SHARED FINANCE SERVICES

Shared Finance Services refer to a model in which various departments, business units, or entities within an organization collaborate and utilize common financial resources or services. This approach is often implemented to streamline financial operations, enhance efficiency, and promote consistency across different parts of the organization.

INTEGRATED BANKING

Bank integrations in Dynamics 365 not only automate and streamline financial processes but also provide real-time insights, accuracy, and security, contributing to overall operational efficiency and financial management effectiveness.

CONSOLIDATION AND INTERCOMPANY

In the realm of finance, consolidation and intercompany processes are critical. This involves harmonizing financial data across entities for accurate reporting and streamlined operations.

FACT BOX

The To-Increase solution contains

- Dynamics 365 FO Finans (powered by Microsoft)

- S365 Business Process Modeler (powered by QualiWare)

- S365 Academy Learning Universe (powered by Eloomi)

- S365 Productivity suite (powered by To-Increase)

- S365 Advanced Banking (powered by SK Global)

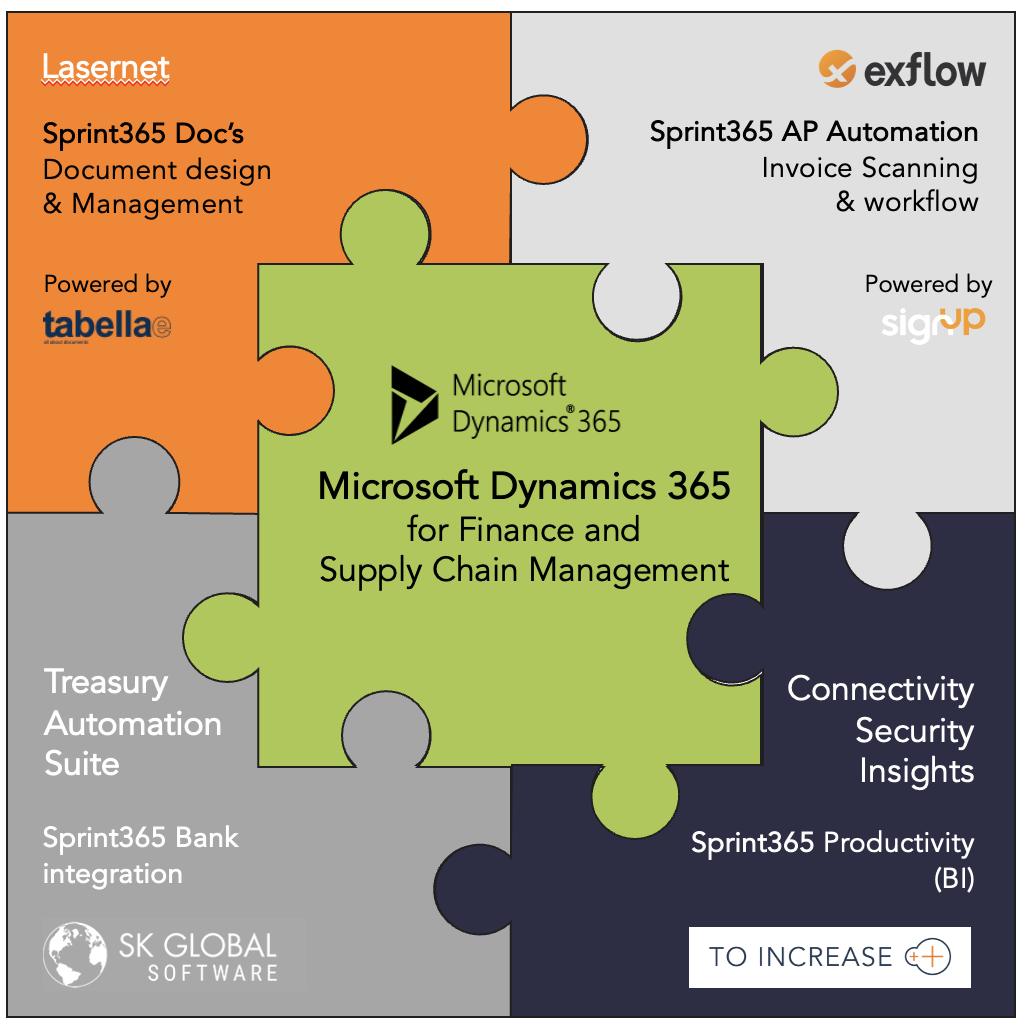

The solution is built on a modular principle, where D365FO forms the core, and additional functionality (so-called ISV modules) can be added as needed.

The entire system is structured as a standard solution, meaning that no special code or individual adjustments have been applied. D365 FO is configured using a Sprint365 template, which is based on “Best Practice” from other similar solutions.